My thanks if you enter my signup code 584255 during the initial signup process.Those who signup with a referral code get $20 back if you spend $200 within 15 days. Please no referral sharing in the comments below.

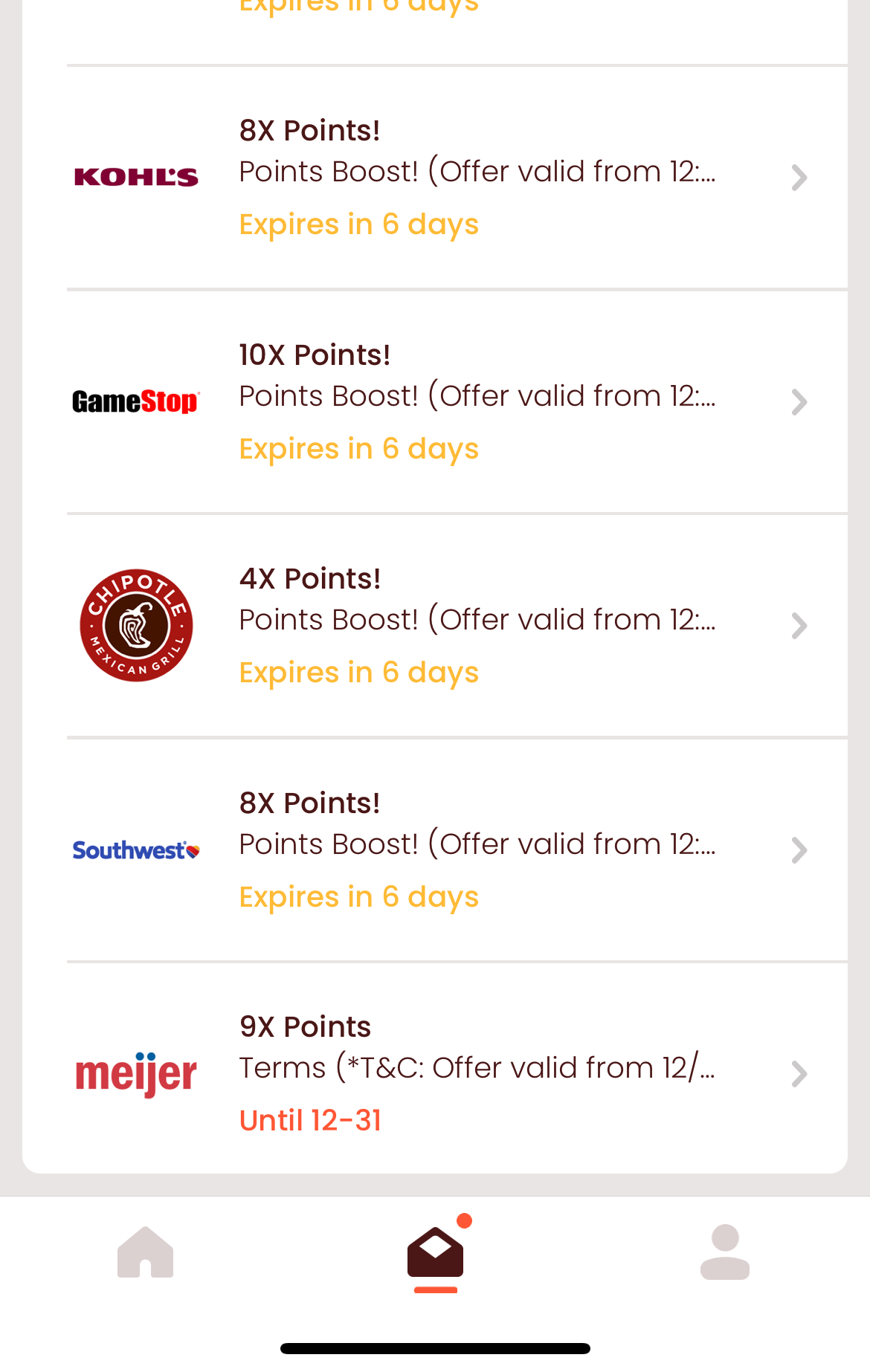

Pepper: Save On Southwest, Giant Eagle, Meijer, Chipotle, Gamestop & More

The Offer

Pepper app is offering the following deals:

- Get 4% back on Chipotle with no limit; offer valid December 23 – December 29

- Get 8% back on Southwest with no limit; offer valid December 23 – December 29

- Get 8% back on Giant Eagle with no limit; offer valid December 23 – December 29

- Get 8% back on Kohl’s with no limit; offer valid December 23 – December 29

- Get 9% back on Meijer; valid December 20 – December 31

- Get 10% back on Gamestop with no limit; offer valid December 23 – December 29

- Get 10% back on Adidas with no limit; offer valid December 23 – December 29

The standard Pepper points will be instantly available and the bonus Pepper points will be awarded for most of these deals on 1/13/25.You can see these deals in your messages tab or notifications tab.Be sure that you should see the bonus reflected on the checkout screen; deals might sell out early.

The Pepper points system is confusing, so let’s give an example: Let’s say, for example, that Pepper is offering 10x on Amazon.If you buy $100 in Amazon gift cards, you’ll get 8,000 points instantly (4x) which is worth $4 toward your next purchase; that’s 4% back.

In a few weeks, you’ll get an additional 12,000 points which is worth $6 and is the same as 6% back.Altogether, you’ll end up with 10x back will is the same as 10% back.It’s easier to just avoid thinking about the points totals and focus on the ‘x’ back since that is the same number as the % back you’ll be getting (1x = 1% back; 10x = 10% back).

You’ll see a tab in the app called ‘Points History’ which will clearly show which points have posted and which points are pending.

Our Verdict

Keep in mind that for most of these deals the bonus points won’t be available for a few weeks, and it’s not worth buying unless you can manage the risk of something going wrong with the bonus points posting a few weeks down the line.

People have increasingly been reporting issues (December 2024) with getting in contact with Pepper reps when issues arise.There have also been times when people have had issues logging in; therefore, I’d recommend screenshotting and copying the gift card info immediately.

I’d also recommend using up the Pepper points as soon as possible to be safe.

These deals stack well with the AmEx Offer for $15 off $50 (valid through 12/31/24).Reports are that Amex Business Gold to earn 4x if it’s one of your top two categories as part of the Computer Software category. And it counts as Computer Software category for BofA Customized Cash Rewards cards for 3%/5.25% and for 1.5x on the Business Platinum card.And reports are that it counts as Online Shopping for BofA cards and Blue Cash card and ShopYourWay card and the legacy Citi AT&T card.And reportedly it counts as Tech for 5% on the Paypal debit card.

Note: While there is no limit to most of these deals, you might be limited in overall quantities that can be purchased from Pepper in a day.

So you might only get $2,000 or some other number until the app stops you.It’s sometimes possible to increase limits by calling in and verifying.And you might be able to buy again the next day as your limits reset.

Publisher: Source link